Webster Chamber News April 2021

President's Column

I cut the grass and now it’s going to snow! You can’t beat the variety of weather we get in upstate New York! So,...

Power Hour

Join us on Friday, May 7th at 8:00 am for "Cyber Security" presented by Russ Ziskind of Gemini Technical Services.

Breakfast Before Business

Our next Breakfast Before Business will be on Friday, April 30th at 7:00 am at the Webster Recreation Center.

Volunteer For The United Way Day of Caring

Sign up here to volunteer for the United Way Day of Caring on Thursday, May 13th!

New Members

The strength of any organization lies in its membership. Thank you for joining. Please add these members to your directory listings.

Recreational Marijuana and the Workplace

Harter Secrest & Emery's Labor and Employment Law Breakfast Briefing Webinar Series.

Speed Social

Join us Wednesday, April 21st at 4:30 pm for our 1st Speed Social (via Zoom).

Webster Community Chest

Now through May 4th, you can purchase a Webster Community Chest special edition bottle of Casa Larga wine that benefits...

Barry's Column

I cut the grass and now it’s going to snow! You can’t beat the variety of weather we get in upstate New York! So, along with the theme of things changing, I am going to be brief in my column this month!

We have lots of exciting things going on with the Chamber: Power Hours; a “new” Speed Social event; in-person Breakfast Meetings; and Eat, Drink & Connect events (in-person) in May. Look over the newsletter for dates and details.

We are looking for nominations for Business of the Month – if you want us to recognize a Chamber business for this honor, please send me an email.

We are looking for businesses to host Eat, Drink and Connect events – this is a great way to showcase your business to fellow Chamber members and a fun social event (that we can all use!).

We are all coming off the “pause” and, albeit slowly, it’s time to think about engaging more with the Chamber and Chamber members. Attending events, participating in a Power Hour, volunteering on a committee, attending a breakfast, bringing Barry & Barb lunch – there are lots of ways to “un-pause” and connect and contribute.

Let us know what’s new (and what’s the same) with you and your business. Update a comment on the Pass-the-Mic page on the website and make sure your Chamber directory listing is up-to-date with all its information (the advertising value of your directory listing is multi-fold: showing your connection to the community and vastly improved SEO results because we a re a Google authoritative website are just a couple).

Lastly, drop off door prizes or something for our new member mugs that will help us promote and brand your business!

Thanks for reading and see you at the next event!

Lake Ontario Ag Consulting, LLC - A crop management technical assistance company. Contact Vaughn at 315-382-6127 or VaughnG@lakeontarioagconsulting.com or visit their website at www.lakeontarioagconsulting.com

Matsunami Karate Inc. - A martial arts studio located at 1998 Empire Blvd, Suite 2, Webster. Contact Baltazar Melendez at 406-8556 baltazar@matsunamikarate.com or visit their website at www.Matsunamikarate.com

The strength of any organization lies in its membership. Thank you for joining. Please add these members to your directory listings.

United Way Day of Caring Volunteer

Reimagine RTS Information

Reimagine RTS is launching on Monday, May 17. Because of COVID-19, RTS is not able to hold in-person gatherings to help educate customers on the new system. Please help RTS make sure customers are ready for the new system by sharing the following information to help them learn what they need to know before May 17:

- Learn your route number: All the route numbers are changing. Use the old route/new route guide to find your new route number. Some customers will need to use a combination of a route and RTS On Demand

- Find your schedule: Once you know your new route number(s), go to myRTS.com/preview to view the new schedule

- Find your On Demand Zone guide: If you need to use the new on demand service to start or end your trip, or you just want to try this new service, go to myRTS.com/preview to see the guide for your respective On Demand Zone

- Download the Transit App: You can see current bus schedules, new bus schedules, and access the RTS Go mobile fare payment tool through the Transit App. Download the Transit app from the App Store or Google Play

- April 27th Customer Information Session: We will be holding a virtual information session on April 27 at 5:30 p.m. to help customers understand the system and answer their questions. Click here to access the meeting link

- Call Customer Service: If you need help with any of these steps please call 585-288-1700 and work with our customer service team to identify your new route and figure out how to use the new system

Speed Social

Open Enrollment

As part of New York's ongoing response to the COVID-19 pandemic, Governor Andrew M. Cuomo announced that the Open Enrollment Period for uninsured New Yorkers will be extended through December 2021. If you need insurance, for any reason, visit our webpage by clicking here or call the Chamber office at 265-3960.

Individuals who are eligible for other NY State of Health programs - Medicaid, Essential Plan and Child Health Plus can enroll year-round.

Webster Recreation Center Professional Development Classes

Click on Image to Register

Harter Secrest and Emery, LLP

To Sign Up, click on the picture

Agency Guidance on Mental Health Parity and Addiction Equity Act Requires Employer Attention

On April 2, 2021, the U.S. Departments of Labor (“DOL”), Health and Human Services (“HHS”), and the Treasury (collectively, the “Agencies”) issued guidance regarding the amendment made to the Mental Health Parity and Addiction Equity Act of 2008 (“MHPAEA”) by the Consolidated Appropriations Act, 2021 (“Appropriations Act”). The guidance is in the form of detailed FAQs that are Part 45 in the Agencies’ series of FAQ guidance publications that began in 2010 (accessible at the DOL website here).

The Appropriations Act requires employers to perform and document a comparative analysis of the design and application of non-quantitative treatment limitations (“NQTL”) under their group health plan and to provide the analysis to the Agencies upon request. The Appropriations Act provision applies to self-insured and insured employer group health plans, as well as health insurance issuers, who must make their comparative analyses available to applicable state authorities.

The guidance emphasizes that the comparative analysis must be performed without regard to whether an Agency has requested it and describes in detail what is necessary for an analysis to satisfy the requirement. The comparative analysis described in the guidance will be a significant undertaking for most employers and will require the cooperation and assistance of their insurance carrier or claims administrator, including pharmacy benefits manager, as applicable. In accordance with the effective date specified in the Appropriations Act, the requirements described in the guidance are effective now.

MHPAEA Background

MHPAEA generally requires that group health plans and health insurance issuers that provide coverage for mental health and/or substance use disorder (“MH/SUD”) benefits ensure that the financial requirements (such as coinsurance and copayments) and treatment limitations (such as visit limits) on MH/SUD benefits are no more restrictive than those that apply to medical/surgical benefits. These requirements are generally referred to as the financial requirements and quantitative treatment limitation requirements (“QTL”). Application of the financial and QTL requirements involves complicated testing of a group health plan’s claim payments.

In addition to the financial and QTL requirements, longstanding MHPAEA regulations require that a group health plan or health insurance issuer not impose an NQTL on MH/SUD benefits under the plan or insurance coverage unless, under the plan as written and in operation, any processes, strategies, evidentiary standards, or other factors used in applying the NQTL to MH/SUD benefits are comparable to, and applied no more stringently than, the processes, strategies, evidentiary standards, or other factors applied to medical/surgical benefits. NQTLs include the following (this is not an exhaustive list):

- Medical management standards limiting or excluding benefits based on medical necessity or medical appropriateness, or based on whether the treatment is experimental or investigative;

- Prior authorization or ongoing authorization requirements;

- Concurrent review standards;

- Formulary design for prescription drugs;

- For plans with multiple network tiers (such as preferred providers and participating providers), network tier design;

- Standards for provider admission to participate in a network, including reimbursement rates;

- Plan or issuer methods for determining usual, customary, and reasonable charges;

- Refusal to pay for higher-cost therapies until it can be shown that a lower-cost therapy is not effective (also known as “fail-first” policies or “step therapy” protocols);

- Exclusions of specific treatments for certain conditions;

- Restrictions on applicable provider billing codes;

- Standards for providing access to out-of-network providers;

- Exclusions based on failure to complete a course of treatment; and

- Restrictions based on geographic location, facility type, provider specialty, and other criteria that limit the scope or duration of benefits for services provided under the plan or coverage.

Group health plans that satisfy the requirements to be “retiree-only” plans and certain non-federal governmental plans are not subject to MHPAEA requirements. In addition, MHPAEA does not apply to employers who employed an average of at least two, but not more than fifty employees on business days during the preceding calendar year and who employed at least one employee on the first day of the plan year. However, if a small employer purchases insured group health coverage (as most employers of that size would do), the coverage itself would be subject to MHPAEA requirements. Also, group health plans that constituted “excepted benefits,” such as a standalone dental plan, a standalone vision plan, a health care flexible spending account, and an employee assistance program meeting certain criteria, are exempt from the MHPAEA requirements.

Appropriations Act Amendment and Agency Guidance

The Appropriations Act amended MHPAEA to expressly require employer group health plans and health insurance issuers to perform and document a comparative analysis of the design and application of NQTLs under the plan and insurance coverage. In addition, the Appropriations Act requires group health plans and health insurance issuers to make their comparative analyses available to the Agencies or applicable state authorities upon request. The comparative analyses must also be made available to participants and beneficiaries (and to their authorized representatives) upon request.

The Appropriations Act specifies a detailed list of information that must be included in the comparative analysis prepared by a group health plan or health insurance issuer:

- The specific plan or coverage terms or other relevant terms regarding the NQTLs and a description of all MH/SUD and medical/ surgical benefits to which each such term applies in each respective benefits classification;

- The factors used to determine that the NQTLs will apply to MH/SUD benefits and medical/ surgical benefits;

- The evidentiary standards used for the factors identified, when applicable, provided that every factor shall be defined, and any other source or evidence relied upon to design and apply the NQTLs to MH/SUD benefits and medical/ surgical benefits;

- The comparative analyses demonstrating that the processes, strategies, evidentiary standards, and other factors used to apply the NQTLs to MH/SUD benefits, as written and in operation, are comparable to, and are applied no more stringently than, the processes, strategies, evidentiary standards, and other factors used to apply the NQTLs to medical/surgical benefits in the benefits classification; and

- The specific findings and conclusions reached by the plan or issuer, including any results of the analyses that indicate that the plan or coverage is or is not in compliance with the MHPAEA requirements.

The guidance emphasizes that the obligation to perform this detailed NQTL comparative analysis is now mandatory, without regard to whether an Agency has requested a copy of the analysis. This will present a challenge to employers, particularly those who self-insure their group health plan benefits, as they typically rely on their claims administrators to develop medical necessity standards and other criteria used to make claim determinations.

Historically, employers have not proactively engaged in extensive analysis of their group health plan’s compliance with MHPAEA, and have instead responded to DOL requests for information regarding compliance with MHPAEA in the course of DOL investigations of health plan compliance with ERISA or specific complaints regarding compliance with MHPAEA. In the case of insured group health plans, an employer whose plan was being investigated typically relied on the insurance carrier to provide responsive information to the DOL, since the employer normally would not have access to the claim information necessary to perform the financial and QTL testing, or information regarding the carrier’s operation of the NQTL provisions. Self-insured employers have generally been more aware of MHPAEA compliance, at least from a plan design perspective, but are reliant on their claims administrators in connection with financial and QTL testing and operation of the NQTL provisions (over which the employer would have little control).

The guidance notes that the DOL’s online MHPAEA self-compliance tool (available on the DOL website here) outlines four steps that plans and health insurance issuers should take to assess their compliance with the MHPAEA NQTL requirements and that the information identified in each step “closely aligns with” the information that plans and issuers must include as part of their comparative analyses. The guidance also says that for an analysis to be treated as sufficient under the Appropriations Act, it must contain a “detailed, written, and reasoned explanation of the specific plan terms and practices at issue, and include the bases for the plan’s or issuer’s conclusion that the NQTLs comply with MHPAEA.” The guidance sets out a detailed list of nine elements and says that “at a minimum” sufficient analysis must include a “robust discussion” of all the elements. The list of elements clearly illustrates that the involvement of the insurance carrier or self-insured plan claims administrator is necessary to conduct a proper comparative NQTL analysis.

Recommendations

Employers should take the time to review the guidance to understand the scope of this new requirement. Employers with self-insured plans should contact their claims administrators to inquire about the claims administrators’ readiness to assist in the performance of the analysis. Our ongoing conversations with several national insurance carriers who serve as claims administrators for self-insured plans lead us to believe that it may be some time before claims administrators are in a position to offer the necessary assistance. Employers with insured plans should contact their carrier to determine whether the carrier is in a position to provide an analysis to the employer. Ideally, carriers, which have to perform the analysis on their insured product, may be in a better position to offer a prepared analysis to employers. Self-insured employers who want to start to prepare the portion of the analysis that an employer can feasibly prepare (a review of plan coverage terms regarding NQTLs and description of the benefits to which the NQTLs apply) should review the DOL MHPAEA self-compliance tool.

If you have any questions about MHPAEA or compliance with the comparative analysis requirement, please contact any member of the Employee Benefits and Executive Compensation group at 585.232.6500 or 716.853.1616.

click here to view Agency Guidance on Mental Health Parity and Addiction Equity Act Requires Employer Attention as a PDF

Webster Community Chest

Click on image to go to site

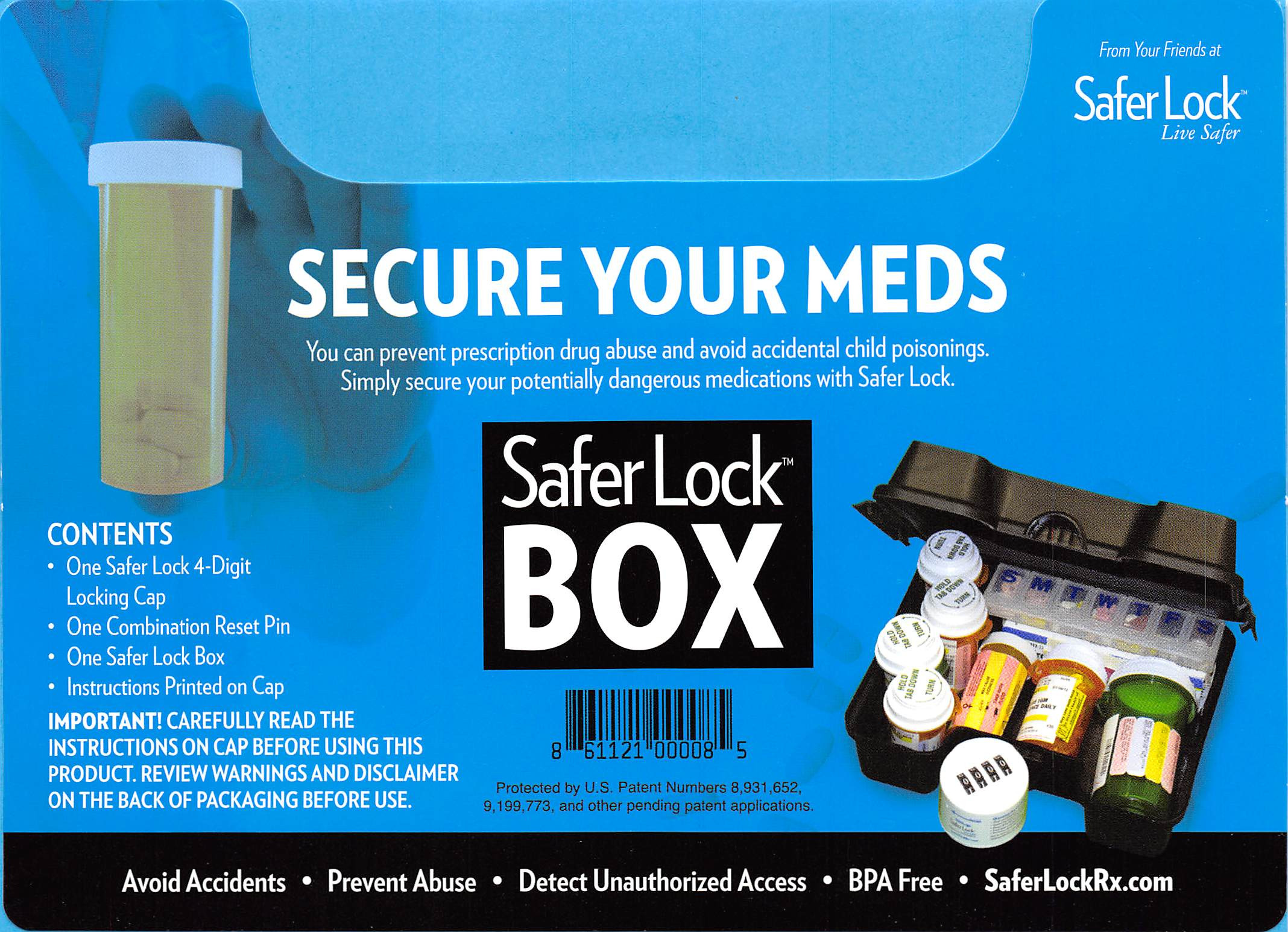

Safer Lock Boxes

Do You Have Prescription Drugs That Need To Be Destroyed?

The Webster Health and Education Network has made available to the Webster Chamber, Deterra that permanently destroys medications. If you have excess supplies of medication that you no longer need, please stop by the chamber to pick up one of these.

McMahon LaRue Associates

McMahon-LaRue Associates has created a new position for a Licensed Civil Engineer with 5-10 years of experience. This position will work alongside the President with over four decades of experience, plus a staff of 9. Interest can be expressed to Info@McMahon-LaRue.com.

Family First Credit Union

Part-time Teller position open at the Webster branch. Contact Georgia Interlicchia at 585-586-8225 x 146 (click here for job posting information)

Lakeshore Painting

Painter / Finisher Full & Part Time (Rochester / Eastern Suburbs) Seeking an experienced Painter/Finisher of new residential homes, spraying experience a plus. Year-round work. Paid vacation and holidays, 401K, Pay is based on experience. Must have your own car (reliable transportation a must/driver’s license). Drug screen and criminal background check required. Call Phil at 585-729-6562 or send email to: LakeshorePainting1@gmail.com

Hair For All Reasons

Looking for a Part-Time Assistant for a family-owned and operated salon. Contact Tracy @ 585-671-0310

Wegmans

Wegmans is now hiring. Check here for more information and job openings: https://jobs.wegmans.com/category/retail-service-center-jobs/1839/29711/1?utm_source=google.com&utm_campaign=pottsville&utm_medium=search_engine&utm_content=paid_search&ss=paid&dclid=CPyN0NPcoegCFUmnaQodpVwNvg

CDS Life Transitions

CDS Life Transitions have a number of positions they are looking to fill: At CDS Life Transitions, it is our mission to champion our constituent organizations in providing exceptional, holistic and innovative support for the people they serve. Our visionary, integrated stewardship provides life opportunities and empowers individuals and their families to live more fulfilling and independent lives. CDS Life Transitions offers many wonderful career opportunities. Working here is a rewarding experience that will give you the satisfaction of helping people with Disabilities, Seniors, and/or Veterans in our community to pursue their personal dreams. CDSLT is currently in search of Registered Nurses, Direct Support Professionals, and CDL Drivers, however, our companies are always hiring for a variety of positions. For more information and to see all current postings, visit www.cdslifetransitions.org